India में जब भी trusted bank loans की बात आती है, State Bank of India (SBI) का नाम naturally सामने आता है. Large network, credibility और structured lending policies के कारण many borrowers search करते हैं — SBI bank se loan kaise le 2026, SBI personal loan online apply, how to apply for SBI personal loan.

लेकिन loan process समझने से पहले सबसे ज़रूरी चीज़ है realistic clarity. Bank loans हमेशा eligibility-driven होते हैं. No bank unconditional approval guarantee नहीं देता — चाहे application online हो या branch से.

इस guide में हम practical और easy-to-understand overview देंगे.

SBI Personal Loan – Conceptually Kya Hota Hai

SBI personal loan unsecured loan category में आता है. इसका मतलब collateral typically required नहीं होता, लेकिन bank repayment capacity और risk profile evaluate करता है.

Loan approval हमेशा applicant eligibility और bank assessment पर depend करता है.

SBI Personal Loan Eligibility – Approval किन Factors पर Depend करता है

Exact criteria समय के साथ change हो सकते हैं, लेकिन banks सामान्यतः multiple parameters evaluate करते हैं:

Applicant age & residency

Income stability & employment profile

Credit score / CIBIL history

Existing EMI obligations

Banking & repayment behavior

Higher financial stability → Better approval probability

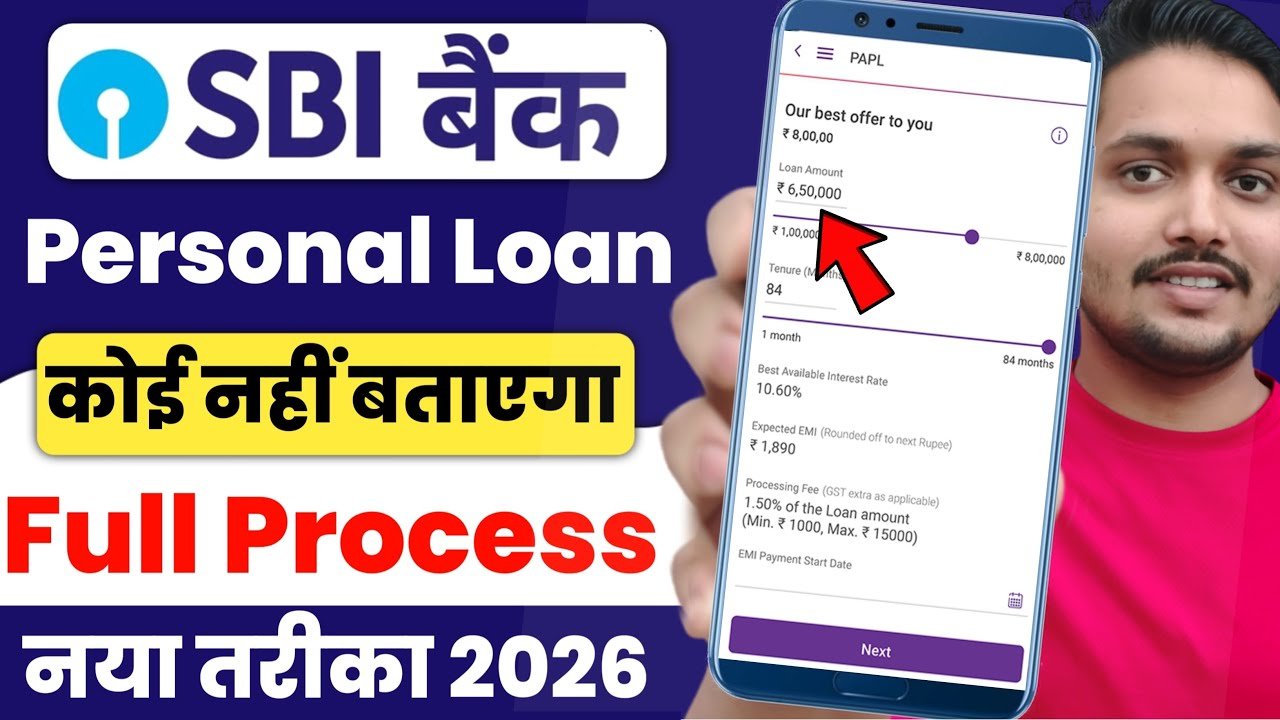

SBI Personal Loan Online Apply – Practical Flow (2026)

Digital banking adoption के कारण SBI loans के लिए online आवेदन possible हो सकता है. Typical workflow broadly इस तरह समझें:

Official SBI website या loan portal visit करें

Personal loan section open करें

Basic details fill करें

Eligibility check complete करें

KYC & documentation submit करें

Bank verification process complete करें

Approval / rejection decision wait करें

Online apply convenience देता है, approval guarantee नहीं.

Required Documents – Typical SBI Loan Documentation

Banks documentation-heavy evaluation follow करते हैं. Common requirements include:

Identity proof (Aadhaar / PAN आदि)

Address proof

Income proof (salary slips / bank statements / ITR)

Employment / business details

Photographs

Exact documents applicant profile पर depend करते हैं.

Interest Rate – कैसे Decide होती है

SBI personal loan interest rates fixed universal numbers नहीं होते. ये depend करते हैं:

Loan type

Applicant credit profile

Risk assessment

Market conditions

Policy structure

Unverified lowest-rate claims cautiously देखें.

Loan Approval – Why Some Applications Get Rejected

Loan rejection बेहद common reality है. Possible reasons include:

Low credit score / limited credit history

Income instability

High existing obligations

Verification mismatch

Policy constraints

Rejection हमेशा unusual नहीं होता.

EMI & Loan Repayment – Critical Understanding

Loan approval के बाद repayment discipline सबसे important factor होता है. EMI delays future credit profile negatively impact कर सकते हैं.

Responsible borrowing mindset बेहद ज़रूरी है.

Instant Approval Myths – क्यों Avoid करने चाहिए

Internet पर “SBI guaranteed loan tricks”, “instant approval hacks” जैसे claims common हैं. Legitimate banks कभी भी guaranteed approvals advertise नहीं करते.

Loan ecosystem हमेशा risk-based होता है.

Risk Awareness – Most Critical Section

Borrowers को हमेशा सावधान रहना चाहिए:

Advance fee scams avoid करें

Unofficial agents ignore करें

Sensitive data unknown links पर share न करें

Only official SBI channels use करें

Golden rule:

Banks कभी भी approval के बदले upfront payment demand नहीं करते.

Realistic Expectations – 2026 Borrowers के लिए

SBI जैसे banks structured & policy-driven lending follow करते हैं. Approval probability improve करने के लिए:

Accurate application details

Clear income documentation

Healthy credit behavior

Realistic loan amount selection

Shortcuts rarely work करते हैं.

Conclusion – Smart Borrowing Always Wins

SBI bank se loan kaise le (2026) का honest answer यही है — कोई magic shortcut नहीं. Approval हमेशा eligibility & bank assessment पर depend करता है. Online apply convenience देता है, guarantee नहीं.

Financial planning और repayment readiness हमेशा priority होनी चाहिए.

FAQ – SBI Personal Loan Se जुड़े Common Questions

1. Kya SBI Personal Loan Guaranteed है?

नहीं. Approval eligibility & bank policies पर depend करता है.

2. SBI Personal Loan Online Safe है?

हाँ, अगर official SBI website / channels use किए जाएँ.

3. Aadhaar Alone Sufficient है?

Normally नहीं. Additional financial checks required होते हैं.

4. Interest Rate Kitna होता है?

Applicant profile & bank policy पर depend करता है.

5. Rejection क्यों हो सकता है?

Credit profile, income या verification issues common reasons हैं.

6. Approval Chances कैसे Improve करें?

Stable income proof & realistic expectations.